The UAE has solidified its position as a leading fashion retail hub in the Middle East, with a retail market valued at $70.5 billion in 2025. Key players like Apparel Group, Chalhoub Group, and Majid Al Futtaim continue to drive growth across various segments.

Factors such as a booming tourism industry, rapid e-commerce expansion, and rising demand for luxury fashion are fueling this growth. As a result, the UAE fashion retail sector is undergoing a transformative shift, characterized by innovation, digital integration, and an influx of global brands.

Current Trends in UAE Fashion Retail

E-commerce Surge

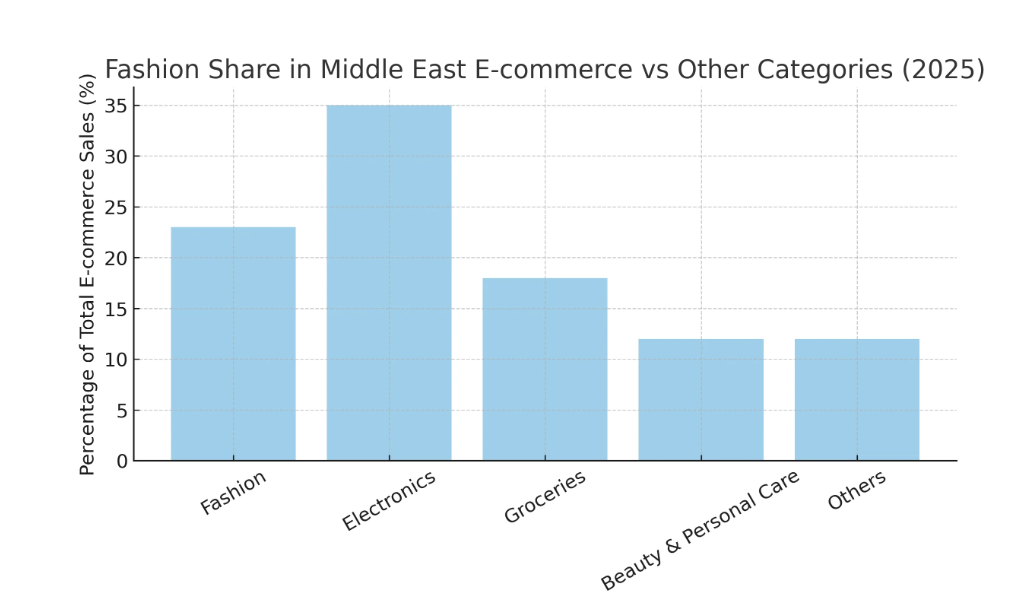

The UAE’s fashion e-commerce market is experiencing rapid growth, with projections estimating it to reach $11.05 billion in 2025, up from $6.23 billion in 2024, reflecting a compound annual growth rate (CAGR) of 15.8% best colorful socks. This surge is driven by high internet penetration, mobile accessibility, and a tech-savvy consumer base. Platforms like Noon.com and Amazon.ae are capitalizing on this trend, with Noon.com alone accounting for over 30% of the UAE’s total e-commerce market share best colorful socks.

Omnichannel Strategies

In 2025, 70% of UAE retailers have integrated digital tools into their physical stores, signaling a significant shift towards omnichannel retail Khaleej Times. Consumers now expect seamless experiences that blend online convenience with in-store engagement. Popular services like “buy online, pick up in-store” (BOPIS) and real-time inventory visibility are enhancing customer satisfaction and operational efficiency The Business of Fashion.

Sustainability Focus

Sustainable fashion is gaining momentum in the UAE, with over 53% of consumers prioritizing eco-friendly purchases LinkedIn. Brands are responding by adopting ethical sourcing, using organic materials, and implementing eco-friendly packaging. For instance, Miniaar, a Dubai-based luxury brand, emphasizes purpose-driven design and sustainable practices Harper’s Bazaar Arabia. This shift reflects a broader consumer demand for transparency and responsibility in fashion.

Key Challenges in Fashion Retail Supply Chains

1. Logistical Complexities

The UAE fashion retail market faces significant logistical challenges, particularly with cross-border e-commerce and international deliveries. Managing customs clearance, shipping delays, and coordinating with multiple international suppliers adds layers of complexity to the supply chain.

Key Challenges:

• Delays in customs clearance and international shipping

• Managing multiple suppliers and shipment routes across various countries

• Difficulty maintaining fast and efficient delivery timelines

Solution Strategies:

• Implementing real-time tracking systems to enhance visibility

• Using automated documentation systems for seamless cross-border logistics

• Partnering with reliable logistics providers to ensure timely deliveries

2. Returns Management

High return rates, often ranging from 15-30% of online purchases, pose an ongoing challenge for fashion retailers. Returns are often due to sizing issues, style mismatches, or the inability to physically touch and try the product before purchase. Efficiently managing these returns is critical for maintaining profitability and customer satisfaction.

Key Challenges:

• Managing reverse logistics for a high volume of returns

• Reintegrating returned products back into inventory

• Increased operational costs due to the returns process

Solution Strategies:

• Streamlining returns processes with automated systems

• Managing reverse logistics to reduce time and costs associated with returns

• Creating customer-friendly return policies that enhance satisfaction and loyalty

3. Market Competition

The UAE fashion market is highly saturated, with both local and international brands competing for consumer attention. Retailers must remain agile and innovative to stand out in a crowded marketplace, balancing cost-efficiency with high-quality offerings.

Key Challenges:

• Fierce competition from both local and international brands

• Constant pressure to innovate and adapt to shifting consumer preferences

• Need to balance cost efficiency with luxury and quality

Solution Strategies:

• Enhancing supply chain agility to quickly respond to market demands

• Implementing data-driven decision-making to streamline operations and remain competitive

• Focusing on operational efficiency to optimize both cost and quality

4. Consumer Expectations

Consumers now expect more than just great products—they demand affordability, luxury, fast delivery, and a seamless shopping experience. Meeting these rising expectations while maintaining operational efficiency presents a challenge for retailers.

Key Challenges:

• Balancing luxury and affordability in product offerings

• Delivering fast and reliable shipping without compromising quality

• Providing personalized shopping experiences

Solution Strategies:

• Leveraging advanced demand forecasting to align inventory with consumer demand

• Optimizing end-to-end supply chain operations for faster deliveries and inventory management

• Focusing on customer experience by integrating both online and offline channels

How SupplyMint Can Help You Stay Ahead in Fashion Retail

At SupplyMint, we’re not just a supply chain management provider, we’re your partner in driving growth, reducing costs, and enhancing customer satisfaction. Our innovative solutions are designed specifically for fashion retailers in the UAE to overcome common industry challenges and elevate your operations.

Transform Your Supply Chain with Our Key Solutions:

DigiSales: Revolutionizing Sales Management

Maximize Your Reach: With DigiSales, we help you manage sales channels seamlessly across all platforms. Whether online or offline, our solution ensures your inventory is always aligned with demand, helping you optimize stock levels and minimize costly stockouts.

DigiProc: Streamlining Procurement

Effortless Procurement: DigiProc simplifies procurement by automating the sourcing, ordering, and tracking of materials and products. With real-time insights into supplier performance, you can make faster, smarter procurement decisions and keep your supply chain running smoothly.

Allokator: Smart Inventory and Allocation

Optimize Your Inventory: Allokator is designed to intelligently allocate inventory across multiple channels and locations. Whether it’s for retail stores, e-commerce platforms, or warehouses, Allokator ensures your stock is always in the right place at the right time.

The Future of UAE Fashion Retail: Key Trends to Watch

1) Digital Transformation: The UAE fashion retail industry is on the cusp of further digital evolution. As e-commerce continues to expand rapidly, fashion brands are increasingly leveraging digital marketing, AI, and omnichannel strategies to reach consumers in new ways. In 2025, e-commerce in the UAE is expected to grow to $41.00 billion, with fashion accounting for a significant portion of this expansion. Social media platforms, influencer marketing, and targeted digital ads are playing pivotal roles in shaping consumer purchasing decisions.

Key Trends to Watch:

• Growth of e-commerce platforms: With increasing internet penetration, online shopping is expected to become the dominant shopping method.

• Social commerce: Platforms like Instagram and TikTok are becoming primary sales channels for fashion brands.

• AI and personalization: AI-driven recommendations and virtual try-ons are changing how customers shop online.

2) Consumer Behavior Shifts: Generation Z and millennials are now the driving force behind fashion trends in the UAE. These younger shoppers value convenience, sustainability, and authenticity, influencing how brands design and market their products. They prefer personalized shopping experiences, with seamless integration between online and offline channels. Their purchasing decisions are also strongly shaped by social media influencers and brand values, such as sustainability and ethical production practices.

Key Consumer Trends:

• Sustainability: Young consumers prioritize eco-friendly and ethically sourced products.

• Omnichannel shopping: A preference for seamless shopping experiences across digital and physical stores.

• Influencer-driven buying: Social media continues to be a major driver of consumer behavior.

3) Regulatory Changes

Government policies and regulations are also playing a significant role in shaping the retail landscape in the UAE. The government has introduced several initiatives to support retail growth, such as easing foreign investment laws, expanding e-commerce regulations, and offering tax incentives to businesses in the retail sector. These regulations ensure that the UAE remains an attractive destination for global brands and a growing market for local businesses.

Key Regulatory Developments:

• E-commerce regulations: Increasing government focus on regulating online transactions and digital sales.

• Foreign investment laws: Policies encouraging international brands to expand in the region.

• Sustainability laws: Growing governmental emphasis on environmental and ethical standards for businesses.

Final Takeaway

To succeed in the dynamic UAE fashion retail market, retailers must remain adaptable, customer-centric, and tech-savvy. Building flexibility into your operations will enable you to quickly respond to market changes, while a focus on personalized customer experiences will drive loyalty and satisfaction.

Additionally, investing in technology, such as automation, and advanced data analytics, will streamline your supply chain, optimize inventory, and create smarter, more efficient processes. Partner with SupplyMint to implement strategies and stay ahead of the competition, ensuring long-term success in the ever-evolving retail landscape.

Frequently Asked Questions

1. How can fashion retailers optimize their supply chain for better efficiency?

Fashion retailers can optimize their supply chain by integrating real-time tracking, automating procurement processes, and using data-driven inventory management. Leveraging technology like AI and automation helps improve demand forecasting, reduce lead times, and ensure products are available where and when needed.

2. How can fashion brands reduce high return rates?

High return rates are common in the fashion industry due to sizing issues and product mismatches. To reduce returns, retailers can provide better sizing guides, enhance product descriptions, and offer virtual try-ons or augmented reality (AR) features. Improving customer service and offering easy return processes also help mitigate return rates.

3. How can retailers balance luxury with affordability in their supply chains?

Balancing luxury and affordability requires an efficient and agile supply chain. Retailers can focus on smart sourcing, manage production costs effectively, and use data analytics to predict demand accurately. Optimizing inventory management ensures that high-end products are available without overstocking, while also offering affordable options.

4. What is the impact of Gen Z and millennial shoppers on fashion trends?

Gen Z and millennials are driving fashion trends with their preference for sustainability, authenticity, and personalized shopping experiences. They prioritize brands that align with their values, such as eco-conscious production and ethical sourcing. Retailers must cater to these demands by offering sustainable options and creating engaging, personalized experiences both online and offline.

5. How can retailers stay competitive in the saturated UAE fashion market?

In a saturated market, retailers must focus on agility, customer-centric strategies, and innovation. Offering a seamless omnichannel experience, using AI-powered insights for inventory and sales forecasting, and delivering personalized customer experiences are key to staying competitive. Additionally, leveraging advanced technology to optimize operations will help maintain a competitive edge.

6. How can fashion retailers integrate online and offline sales channels?

Retailers can integrate their online and offline channels through omnichannel strategies, ensuring that inventory is synced in real-time across platforms. This allows customers to buy online and pick up in-store (BOPIS), check product availability online, and enjoy a consistent shopping experience across both channels.